Once upon a time in American marriages, the husband “brought home the bacon” and made all the big financial decisions, and the wife received a “household allowance” to buy groceries and other everyday necessities. Today you might need to watch a 1950s sitcom to find that dynamic. Not only have women entered the workforce in large numbers but they have risen to high-level positions in the business world. On average, women in dual-earner households earn around half the family’s income, and about one out of four married women earn more than

their husbands.

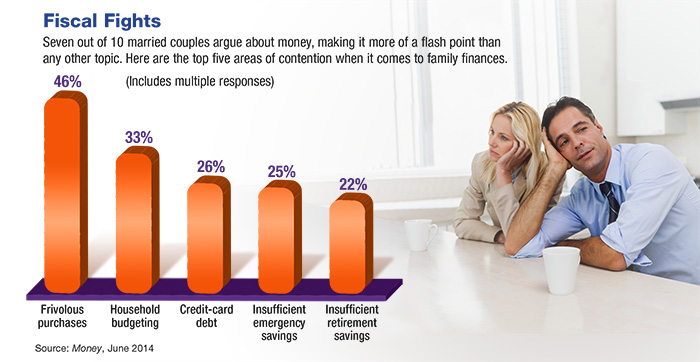

A recent survey provides insight into some of the issues that modern couples face when it comes to money management. Not surprisingly, the higher-earning spouse tends to drive financial decision making. Wives who are higher earners place more emphasis on sharing financial decisions with their spouses, whereas higher-earning husbands are more likely to make these decisions themselves.

Despite the stereotype of men being threatened by successful women, men whose wives earn as much or more than they do actually report higher levels of happiness.

But higher-earning wives are more stressed about money than higher-earning husbands or lower-earning wives, perhaps because they are trying to balance the “traditional” woman’s role while also carrying the financial load.

Clear communication and working as a team may yield better results and help create a stronger marriage, regardless of individual earnings. Here are some steps you and your spouse can take to forge a more successful financial partnership.

Create a budget. Only 32% of households have a budget to track monthly income and expenditures, and only 30% have a long-term saving and investment plan. Budget for your basic monthly expenses and include monthly payments/set-asides for other regular expenses, emergency savings, and retirement savings.

Prioritize discretionary spending. Once you have budgeted together for necessities and savings, each spouse should make a “wish list.” Compare lists and focus on areas of agreement. If a tropical vacation tops both lists, that’s a great goal. But if one of you wants a vacation and the other wants a new car, you’ll have to discuss the pros and cons.

Allow some personal freedom. Consider putting money into a joint account to pay regular expenses and keeping some discretionary funds in separate accounts that you can each use as you wish, up to a mutually agreeable limit. One study found that men would spend an average of $1,231 without discussing it with their wives, but women would only spend an average of $396 without discussing it with their husbands.5 Setting a limit in advance could help prevent conflict down the road.

Recognize individual strengths. If one partner is more comfortable investing and the other is more focused on paying bills on time, there’s nothing wrong with giving more responsibility to one person for certain aspects of your financial life. Just keep the other spouse in the loop.

The bottom line is that no one person really controls the cash — it belongs to both of you. By working together, you might get more out of your “bacon” no matter who brings it home.

To read the full article click HERE